is nevada tax friendly for retirees

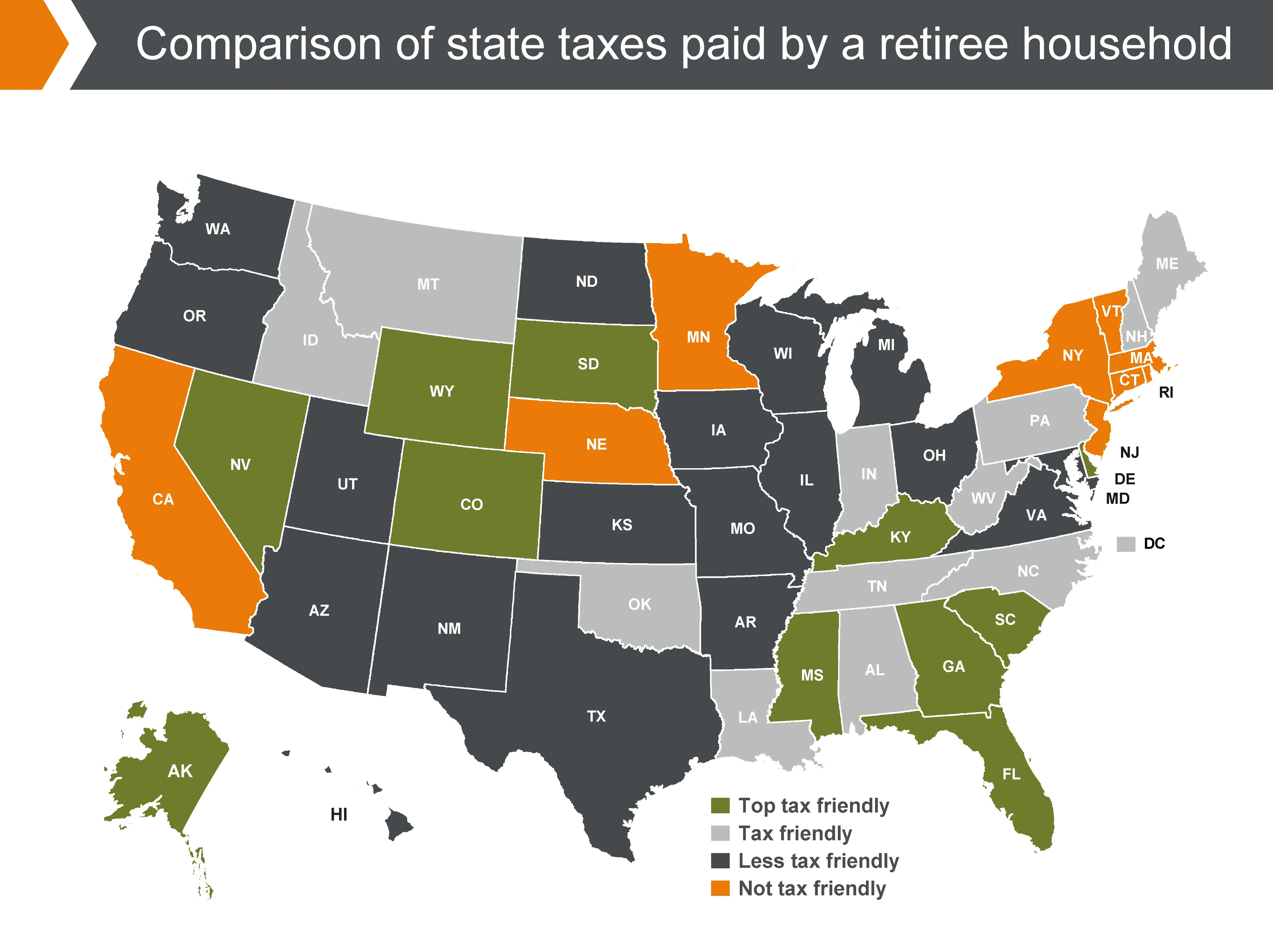

Its sales tax rates are among the lowest in the nation and its average effective property tax rate is just above the national average. Which States Are the Most Tax-Friendly for Retirees.

Nevada Retirement Tax Friendliness Smartasset

We have it all.

. If you like casino life this is Nevada after allthere are several small casinos and one that is fairly large yet they maintain the appearance of a rustic small town. A Beginners Guide to Self-Employment Income Taxes. Nevada is the place if you love a dry climate and the desert as your backdrop.

When You Must File a Nonresident State Tax Return. Federal Tax Rates and Tax Brackets. The culprit for Nevadas pension problems could be the states labor market as its unemployment rate of 49 is the fifth-highest in the country.

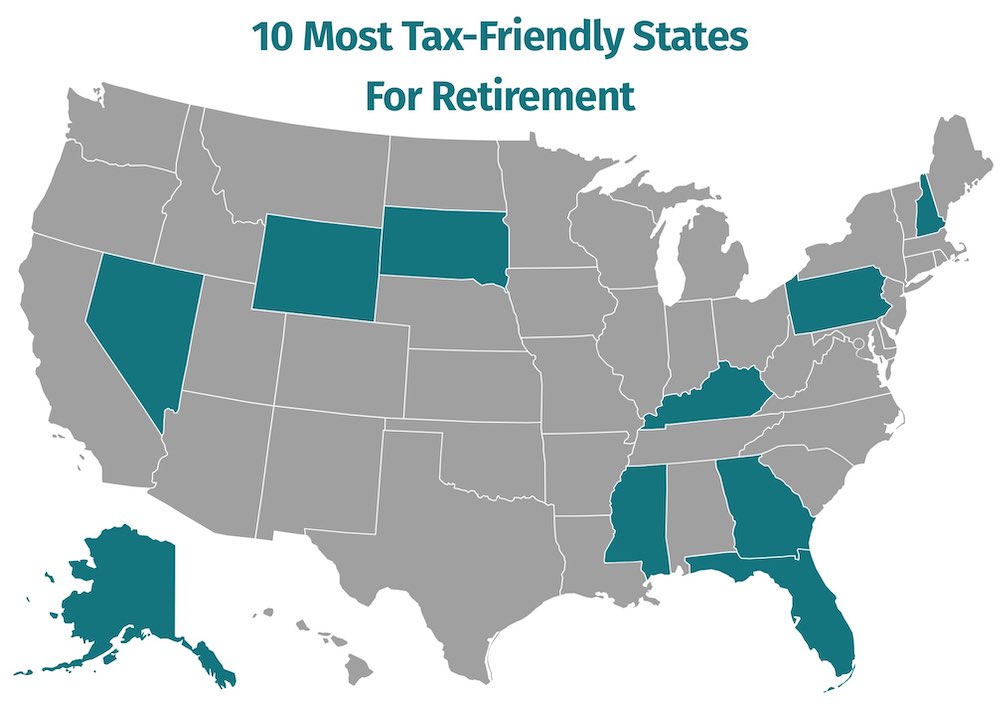

In Arizona the exemption officially went into effect on July 1 2021 and will be retroactive to January 1 2021. Retirees in these states are likely to have a higher overall state and local tax burden than retirees in other states. February 18 2022 10 Most Tax-Friendly States for Retirees.

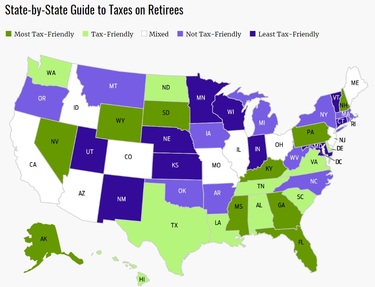

The state imposes a. Thirty states exempt all Social Security benefits from taxation. To determine the top 25 tax-friendly state for retirees GOBankingRates examined data from the Tax Foundation on each states 1 2021 combined state and average local sales tax rate 2 state tax on Social Security benefits 3 effective state property tax rate and 4 state marginal income tax rate that would apply to the 2019 national.

Each state has a different mix of tax breaks for retireesmost exempt certain types of retirement income but they tax others. Sales tax is one area where Nevada could do better. Nevadas average property tax of 069 percent falls in the lowest fourth of the nation.

Alabama Hawaii and Illinois exempt nearly all. Its home to one of the most visited places in the world Las Vegas and. While residents pay 814 percent in sales taxes there is no state income tax and retirement income is not taxed.

For more information. Nine states include Social Security benefits in taxable income but they provide exclusions exemptions and deductions. But overall Arkansas is a tax-friendly state for retirees.

In both the states legislation has been signed that totally exempts military retirement pay from state income tax. Are Social Security benefits taxed. South Dakota is one of the most tax-friendly states especially for retirees.

2021-2022 Federal Income Tax Brackets. Florida also has no estate or inheritance tax and sales tax rates are close to national marks. That means that the millions of out-of-town tourists who try their luck at the craps tables in Las Vegas and travel around the state end up footing most of the bill.

Nevada Nevada has an effective rate of 676 for all state taxes or 4058. Everyone is friendly if theyre local. Florida is also friendly for retirees due to the fact that Social Security retirement benefits pension income and income from an IRA or 401k are all untaxed.

Median monthly adult day care cost. There are some tiny hole-in the wall bars where locals hang that are fun and many many adorable antique shops and second hand stores to browse. But even if youre not into the desert travel up towards Reno for a change of pace.

Military retirees living in Arizona and Nebraska have received good news about their tax bills. Personal and property taxes are collected by local governments and used to provide funding for public school systems and city- and county-level projects and. Nevada 0 None.

The retirement system of Alabama manages some 23 funds with total assets of more than 40 billion but its still looking at almost double that in total unfunded liabilities. Understanding the Illinois Flat Rate State Income Tax. On top of an above-average sales tax rate Nevada also leans heavily on revenue collected from sin taxes on alcohol and gambling as well as taxes imposed on casinos and hotels.

LGBTQ retirees will probably prefer some of Phoenixs well-preserved historic neighborhoods or the nearby suburbs of Tempe Chandler or Ahwatukee.

Nevada Retirement Tax Friendliness Smartasset

Which States Have The Lowest Property Taxes Property Tax Usa Facts History Lessons

10 Most Least Tax Friendly States For Retirees Cheapism Com

States With The Highest And Lowest Taxes For Retirees Money

The Best And Worst States For Retirement 2021 All 50 States Ranked Bankrate Clark Howard Retirement Best Places To Retire

7 States That Do Not Tax Retirement Income

Tax Friendly States For Retirees Best Places To Pay The Least

The Most And Least Tax Friendly Us States

Top Income Tax Rate By State States With No Income Tax 1 Alaska 2 Florida 3 Nevada 4 South Dakota 5 T Retirement Income Best Places To Retire State Tax

Coyote Springs Nevada Nevada Las Vegas Carson City

Kiplinger Tax Map Retirement Tax Income Tax

Retiree Tax Map Reveals Most Least Tax Friendly States For Retirees Senior Living Proaging News By Positive Aging Sourcebook

Map The Most And Least Tax Friendly States Yahoo Finance Best Places To Retire Map Life Map

Tax Friendly States For Retirees Best Places To Pay The Least

The Best Place To Retire Isn T Florida Best Places To Retire Retirement Locations Retirement

Nevada Tax Advantages And Benefits Retirebetternow Com

Top 10 Most Tax Friendly States For Retirement 2021

State By State Guide To Taxes On Retirees Retirement Advice Retirement Locations Retirement